Certified Development Companies (CDCs) facilitate 504 loans to small businesses by partnering with conventional lenders. 504 loans are guaranteed by the U.S. Small Business Administration

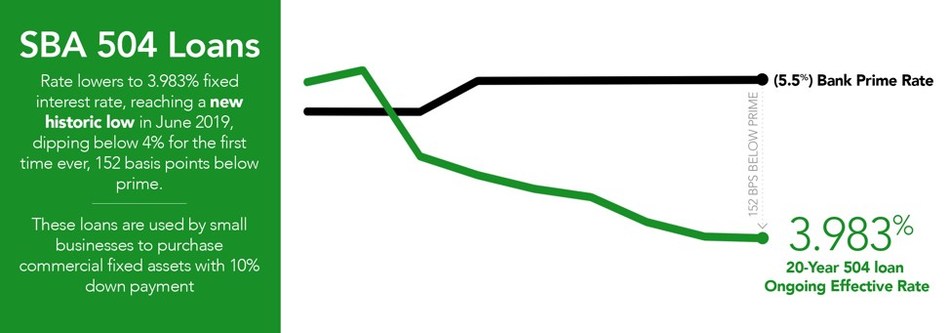

Borrowers of SBA 504 loans this month will be in the first class of small business borrowers with 504 financing fixed at a rate below 4% in the program’s history. The 20-year effective rate for the June sale was 3.98%, edging below the 4.01% record set in December 2012. This is the first time a 20-year 504 effective rate calculation has been this low.

Another standout metric is the 504 rate when compared to the current prime rate. At 152 basis points under the Bank Prime Rate, the June funding is the furthest below prime that 20-year rates have been since May 2007. Even if the Federal Reserve makes the two ¼-point policy rate cuts anticipated by the market this year, the 504 effective rate may remain approximately one full point below prime (not including any additional spread over prime charged by many commercial real estate lenders).

*The 3.98% rate referred to is the current fiscal year effective rate, defined as the 20-year maturity effective rate calculated by the Central Servicing Agent.

SOURCE: National Association of Development Companies (NADCO)